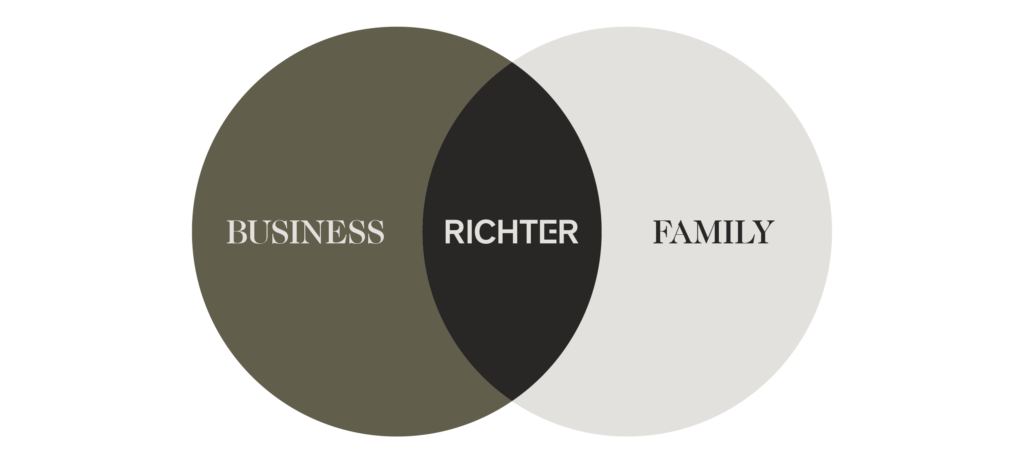

How Richter Is Advising at the Intersection of Business and Family

Successful business owners know that there is a certain complexity that resides at the intersection of business and family matters. For owners who are struggling to align the two, professional expertise can be hard to find. In fact, there was no such offering until Richter, a Canadian-based firm with a presence in the U.S., innovated with an entirely new category in the market: the Business | Family Office.

At its core, the Business | Family Office model is designed to serve both the business and personal interests of Richter’s clients and act as an integrator at the centre of the business and family. Business owners make decisions every day that could impact their families, legacies, transfer of wealth and financial sustainability. Richter’s integrated approach enables the firm to establish a trusted relationship with its business owners that can successfully evolve over generations.

How does Richter’s Business | Family Office serve the needs of long-term clients?

Tasso Lagios: Successful business owners have the additional challenge of understanding how the family will impact the business and vice versa. The alignment of those interests is key to success in business and wealth transition. Our Business | Family Office uses an integrated approach to assist private clients and business families.

Our model encompasses two platforms. The first, Richter Consulting, is a boutique value-creation business advisory practice that ensures that the long-term strategy of the business aligns with the objective of the owners. Business leaders are supported in all their business needs—from foundational services like financial reporting and tax planning to key strategic advice to help achieve their business growth and succession objectives.

The second platform, Richter Family Office, is an integrated in-house platform delivering independent strategic advice on families’ financial and personal objectives across generations. This includes wealth management, family operations, finance, governance, estate planning, philanthropy and financial literacy.

This integrated approach addresses all of the client’s needs, whether business, personal or both—ensuring that each decision is being made with the owner’s interests and their family’s interests in mind. We are the only firm to service both their business and family interests in such an integrated manner.

What unique approach to business advisory and family office services does Richter offer Canadian business owners?

Marc Yedid: Business owners often come to realize that their company’s long-term objectives need to be reevaluated to ensure alignment with their family’s interests. We act as an integrator for business owners; we help them define long-term goals and objectives, assess the current situation and establish a unique road map. Our collaborative thinking, coupled with transformational conversations, means business owners will gain insight and the foresight to seize opportunities and navigate uncertainties, backed by a team of professionals.

Lagios: We understand the impact people and emotions have on both business and family matters. It is with a deep understanding of the family dynamics and their history that we assist our clients in their entrepreneurial journeys. Our approach is to find a delicate balance between business owners and their families in a manner that builds trust and open communication. To build and maintain relationships across multiple generations, it’s crucial to be an active listener, ask the right questions and the tough questions, and build personalized plans with long-term goals in mind. I’d say this is one of the most unique aspects of our approach.

Why is it important to have a single firm assist clients with both their business and family matters?

Yedid: In an ever-changing and complex environment, owners require services from many different experts, and are seeking coherent and business-like advice. They need a holistic and integrated approach. Imagine you need a firm for an audit, someone else for a business valuation, someone else for wealth management, and another advisor to go over your estate planning. Business owners lose valuable time and energy navigating all these aspects separately, but they do it because that’s the way it has always been done. Even worse, they don’t have anyone by their side who sees the full picture from both a business and family perspective. Our approach is integrated, which means our team works collaboratively to help address each of these matters simultaneously. The strong relationships we build with our clients help us bring our integrated approach to life because we understand their values, we know their long-term goals and we know who they are, what they do and what they stand for.

What is your advice for business owners seeking growth and success?

Yedid: Our advice is often to define a long-term growth objective. What does growth mean? It can be financial, social, economic or one of several other variations. Once this is determined, it comes down to strategic and financial planning, organizational design, and more. The best starting point, in this case, is to define objectives and make sure they align with personal/family goals.

Lagios: When you work with owners as closely as we do, you soon come to the realization that it’s never just about making more money. When you commit most of your energy to growing a business, as business owners do, you want it to last for multiple generations and have an impact on the community. It is more about establishing a vision and long-term legacy based on family values. You can’t build it all by yourself; you need a team who will be by your side each step of the way. Surround yourself with the right people—a team that is committed to understanding your unique reality.

Click here to learn more about Richter and their new Business | Family Office.